By: Tito Chapman

The Federation of St. Kitts and Nevis is now recognised by the European Union (EU) as a jurisdiction which is fully compliant for tax purposes.

In a press release dated 18 February 2020, the European Council confirmed that Saint Kitts and Nevis is among 16 jurisdictions who “managed to implement all the necessary reforms to comply with EU tax good governance principles ahead of the agreed deadline.

The Finiacial Services Regulatory Commission, Nevis Branch stated that their mandate is in alignment with the EU tax good government principles.

They said:

It is also in alignment with the Financial Services Regulatory Commission – Nevis Branch’s mandate to build Nevis’ profile as a reputable and well-regulated international financial centre.

The Financial Services Regulatory Commision press statement said:

Saint Kitts and Nevis has been a cooperative jurisdiction and this recent development demonstrates our commitment to comply with international standards on transparency and exchange of information for tax purposes.

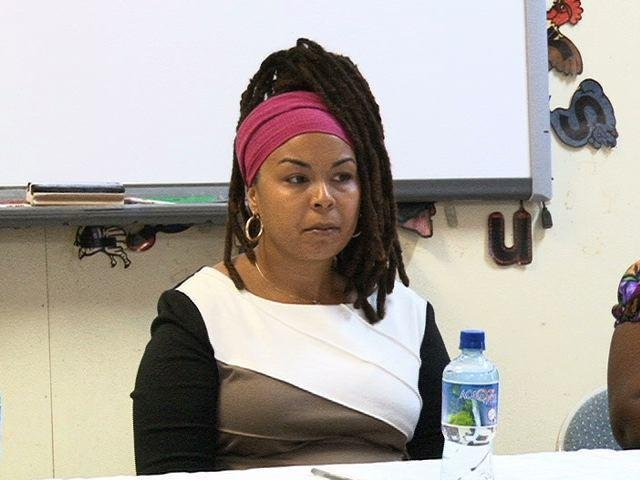

Ms. Heidi-Lynn Sutton, Regulator In October 2018, the OECD Global Forum on Transparency and Exchange of Information for Tax Purposes published the Second Round Peer Review Report on Saint Kitts and Nevis. The Federation was given an overall rating of LARGELY COMPLIANT following an analysis of the effectiveness of its legal, regulatory and administrative frameworks for transparency and exchange of information.

15 other jurisdictions were removed from Annex II.

They are Antigua and Barbuda, Armenia, the Bahamas, Barbados, Belize, Bermuda, the British Virgin Islands, Cabo Verde, the Cook Islands, Curaçao, the Marshall Islands, Montenegro, Nauru, Niue and Vietnam.

Trinidad and Tobago is one of eight jurisdictions that were already on the EU’s list of non-cooperative tax jurisdictions. The other seven jurisdictions are American Samoa, Fiji, Guam, Samoa, Oman, Vanuatu and the US Virgin Islands.