Source: ECCB

The ECCU Credit Bureau, which is scheduled to be launched in December, will make it easier for people to access credit in a timely manner and to use their good credit history as collateral.

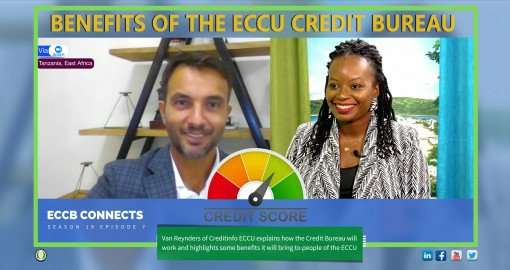

Speaking on the second episode of a two-part interview of ECCB Connects, Project Specialist of Creditinfo ECCU, Van Reynders, explains that the aim of a credit bureau is to improve the lives of businesses and consumers alike with the main objective of simplifying the lending process. This is achieved, he says, by all the players who make up the lending process system including: the ECCB, the ECCU Credit Bureau, the lending institutions and the consumers.

Reynders makes reference to a farmer who may not have the capital required to expand his business or a citizen who wishes to invest in a home. He says that in both instances, the borrower can use his or her good reputational collateral of past credit history to quickly access the funding needed, which may even result in favourable and reduced lending rates.

Reynders advises that the responsibility falls on borrowers to build a positive credit track record by managing their debts or expenses, paying accounts on time, and communicating with their lenders. He adds that borrowers may obtain an annual credit report free of charge which can be checked and reviewed to ensure and maintain a good credit history.