Living paycheck to paycheck is exhausting. As soon as your paycheck comes in, you have to spend it all on necessities like rent, utilities, insurance, and paying off debt. There’s usually little, if anything, left for savings or recreational activities.

Then, something even worse happens: you’re hit with a fee. You might have missed a payment deadline, overdrawn your account, lost your credit card, or encountered a different situation that decided your wallet needed another gut-punch. It might only sound like $12, the cost of a cheap meal out, but it’s $12 you don’t have and desperately need for something else.

You might feel dread toward these impending fees when you pay a bill, or they come at you from out of nowhere. If you live paycheck to paycheck and want to make sure as much of your hard-earned money goes where it should, follow these seven tips for avoiding unnecessary fees.

Avoid Banks that Charge Maintenance Fees

Bank “maintenance fees” are particularly sinister. Financial institutions charge them if you don’t meet specific requirements, such as holding a minimum balance in your account ($1,500 in the case of many big banks) or making frequent direct deposits over a specified amount. You might not even be aware of them unless you check your billing statement.

It’s not fair that banks charge you money for not having enough money. Maintenance fees are often monthly and can accumulate over time — Americans paid $3.5 billion in maintenance fees in 2017. These fees perpetuate the poverty cycle because if you live paycheck to paycheck or have irregular income (like freelancers), of course you don’t have $1,500 in your account at all times.

Don’t use banks that charge maintenance fees. Many big banks do, but examples of financial institutions that don’t include Ally Bank, Capital One Bank 360, and FNBO Direct.

Deposit Money the Long Way

Deposit money into your account the long way, if possible. This process means being patient when getting paid, especially if you’re a contractor or freelancer that relies on services like PayPal.

PayPal offers multiple bank transfer options, including Standard Transfer and Instant Transfer. The former is free and takes one to three business days, but the latter costs 1% of the transaction up to $10. Opt for the Instant Transfer option when you can, or use mobile deposit with a physical check.

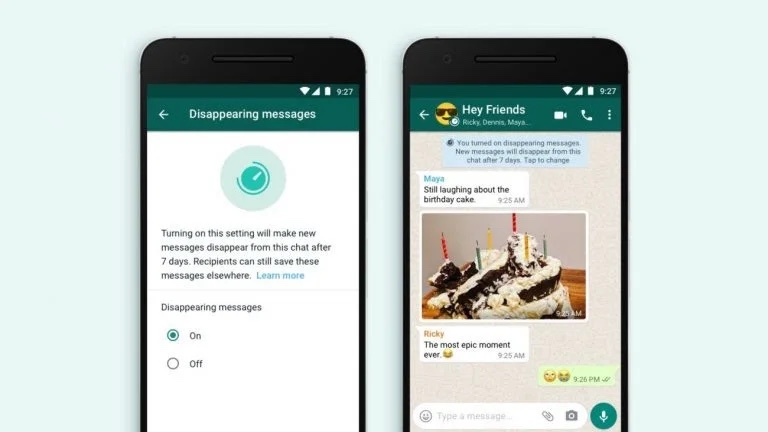

Use Apps that Don’t Charge Minimum Fees

However, the pay cycle is notorious for delays that make living paycheck to paycheck even more difficult. It’s entirely possible that you need your money now, not later — but what can you do about it? You can’t exactly force direct deposit to go faster.

One solution is to use financial apps that allow you to access your paycheck without having to wait weeks for it. One such app is Earnin, which you can use to access up to $100 of your paycheck per day, up to $500 per pay period. The app deducts the amount you took out on payday without mandatory fees or interest. Earnin is community-driven, so you can pay however much you think is fair as a thank you for its service.

Set Up Auto Pay

Are late fees the bane of your existence because you regularly forget to pay a bill on time? Apps like Earnin can help you avoid late fees, but consider setting up auto-pay on your credit card and other if you can afford to do so. This way, you never have to remember payment deadlines; your account will pay what you owe automatically.

Sign Up for Low-Balance Alerts

If you cannot risk auto-pay because you’re worried about insufficient funds, then sign up for low-balance alerts with an app or through your bank. Low-balance alerts will notify you when your account balance has dipped below a certain number — possibly of your choosing, depending on the service — so that you know when it’s time to replenish your account with additional funds or to watch your budget before bills are due.

These alerts aren’t perfect because banks can be slow to share information with external apps. However, they can help avoid bank overdraft fees, which financial institutions charge if you opt-in to its overdraft protection service. While the ability to overdraw your checking account and complete transactions regardless of funds seems convenient, there are other pros and cons to consider (you can also open a checking account with no overdraft fees).

Use Your Bank’s ATMs

ATM fees are one of the most-hated fees in the U.S. You incur these fees if you want to access your money from a machine that’s not in your bank or credit union’s network.

Only use ATMs within your financial institution’s network when possible. If none are around, you can obtain cash at a supermarket that offers cash back options with a small purchase (which sounds like a fee in itself, so only buy something you need!).

Opt-Out of Paper Communications

Your bank is going to communicate with you, and you would be wise to pay attention. Unfortunately, many banks default to mailing paper communications instead of using digital means — and then charge you for it. Log into your online account or call your bank’s customer service line to opt-out of paper notifications and save yourself some cash.

Unnecessary fees make it extra challenging for people living paycheck to paycheck to save money. If you want to lose as little of your money as possible to predatory financial institutions, research what fees your bank (or prospective bank) charges and which they are most likely to make you pay, depending on your situation.

This article originally appeared on Earnin.