Photo Caption: Internal Auditor Zahvelisia Claxton at the ACAMS 23rd annual Anti-Money Laundering (AML) & Financial Crime Conference.

PRESS RELEASE…(May 31, 2018) — From credit risk management to anti-money laundering, officers (staff and committee members) of the Nevis Co-operative Credit Union (NCCU) Limited continue to sharpen their skills in key finance-related areas.

From the second quarter of 2018, staff members have been exposed to local, regional and international training to improve their knowledge and competencies.

On May 22, the NCCU was represented at a Preparation before Legislation Seminar, held on St. Kitts and organised by the Caribbean Credit Bureau Limited.

Staff and committee members also attended the 13th annual Anti-Money Laundering and Countering Financing of Terrorism (AML/CFT) Awareness Seminar and Training Workshop, held on May 14 and 15 at the Four Seasons Resort, Nevis and organised by the Financial Services Regulatory Commission (FSRC), Nevis Branch.

The Nevis Credit Union, whose vision is to be the premier financial institution of members resident in St. Kitts and Nevis and the diaspora, has recognised the need for training in other areas as well.

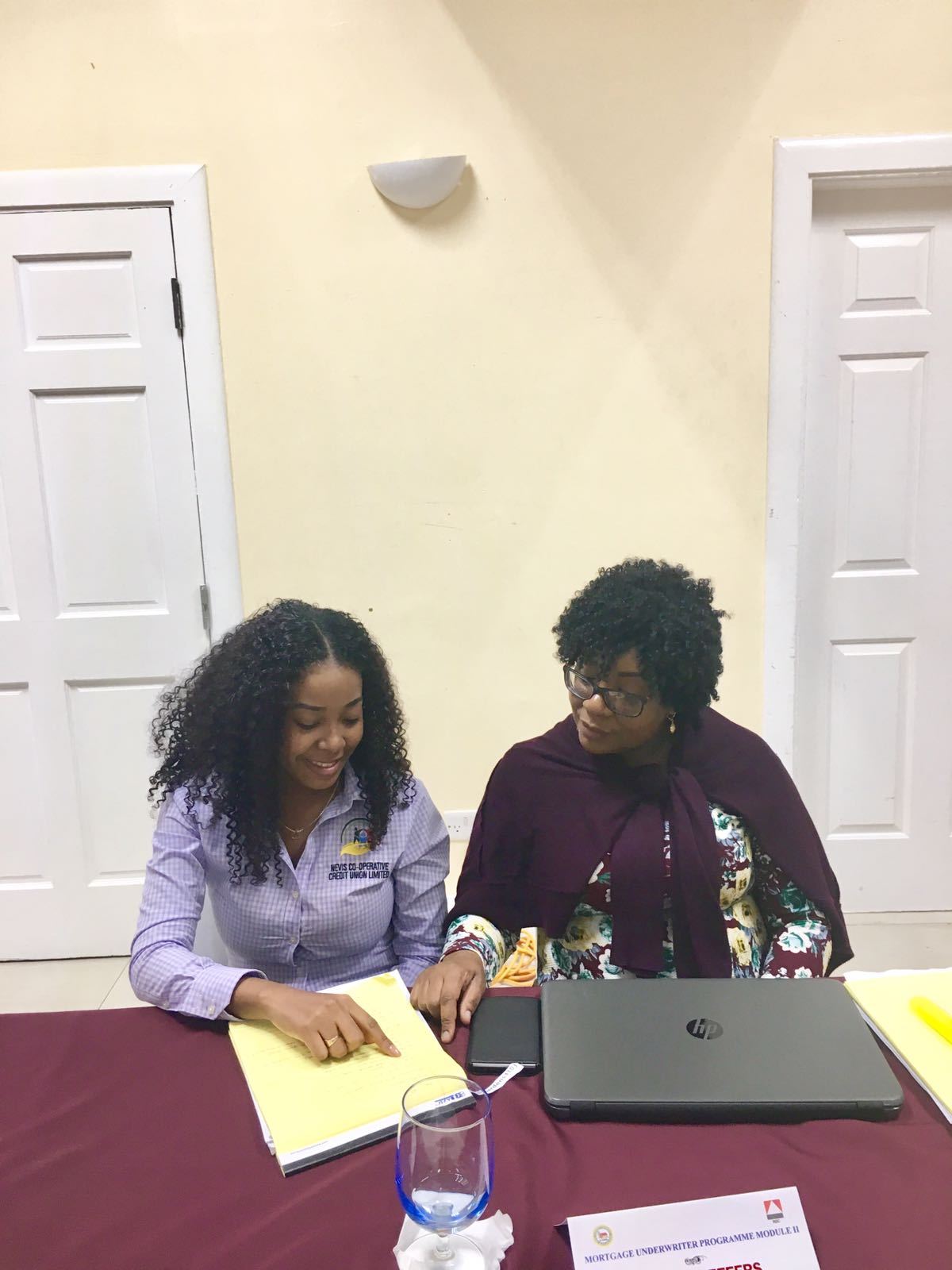

Photo Caption: Senior Loans Officer Tamalyn Vyphuis and colleague participating in the Eastern Caribbean Home Mortgage Bank and Real Estate Institute of Canada’s Mortgage Underwriter Programme.

During the week of May 9-11, two senior employees attended a Career Development Series Workshop on St. Kitts where emphasis was placed on supervisory skills and performance appraisal.

Meanwhile, two employees received Audit Committee Certification when, from April 30-May 1, they, along with other members of St. Kitts and Nevis’ financial services sector, participated in the 21st century Audit Committee and Certification Programme of the Caribbean Governance Training Institute.

Photo Caption: Loans Manager Ken Williams and Senior Loans Officer Earther Scarborough with colleague at the Caribbean Confederation of Credit Unions/Antigua and Barbuda Co-operative League Limited Credit Risk Management Workshop.

The Loans Department has been high on the company’s agenda, where training is concerned. So far this year, three senior-level employees have attended workshops with some of their regional counterparts.

When Senior Loans Officer Tamalyn Vyphuis returned to work from the Eastern Caribbean Home Mortgage Bank and Real Estate Institute of Canada’s Mortgage Underwriter Programme in St. Lucia, she was reenergized.

That programme, as explained by Ms. Vyphuis, focused on “property risk assessment, credit and underwriting.”

Similarly, longstanding employees Ken Williams and Earther Scarborough are now more equipped to perform their duties as Loans Manager and Senior Loans Officer respectively.

The duo had the opportunity to refresh their skills in the area of risk management when they, in April, attended the Credit Risk Management Workshop at the Halcyon Cove in Antigua. That workshop was organised by the Caribbean Confederation of Credit Unions in collaboration with the Antigua and Barbuda Co-operative League Limited.

Describing one of her recent training exercises as “both enlightening and informative”, Internal Auditor Zahvelisia Claxton was among thousands of participants from countries around the world at the Association of Certified Anti-Money Laundering Specialists’ (ACAMS) 23rd annual Anti-Money Laundering (AML) & Financial Crime Conference in Hollywood, Florida from April 9-11.

At the Nevis Co-operative Credit Union Limited, it is important that staff refresh their skills and keep abreast of financial happenings as well as regulatory matters worldwide.

About the Institution

Doing business with the Nevis Co-operative Credit Union gives you more advantage than other institutions. Best of all, you’re a part owner of the credit union-which means that earnings are paid back to you, not stockholders. We offer higher dividends and low interest rates. NCCU is a not-for-profit organisation that proudly serves the community and supports local organisations throughout Nevis.

END

Disclaimer